By Gino Blefari

This week my travels find me getting work done in an unseasonably cold Northern California. And while checking emails and conducting conference calls, the following message was also busy sending the Twitter world abuzz:

The tweet, written by CNBC reporter Diana Olick, referred to the Federal Reserve’s decision (check #FedDecision for the latest tweets) to raise the target federal funds rate by a quarter point, the first time rates have been raised in any meaningful way since 2006. The move, in the context of Federal Reserve history, may appear monumental but Diana gets the story completely right when she says it just doesn’t matter.

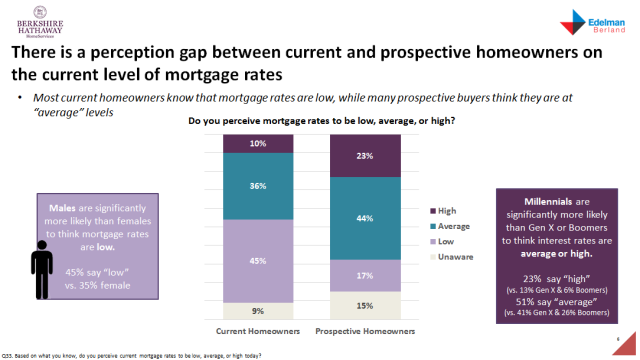

In our latest Berkshire Hathaway HomeServices Homeowner Sentiment Survey, shared several hours before the Fed went public with its announcement, we found that 67% of prospective homeowners already categorized the level of today’s mortgage rates as “average” or “high.” This number is pure reflection of a simple fact: An entire generation of first-time buyers have never experienced a meaningful rate increase and have no previous experience with mortgage rates.

Further, the survey found that should mortgage rates rise in response to a boost in the fed fund rate – and as we all know, they did – many prospective homeowners said they would have to alter their home searches and 51% would adjust their savings pace. In addition, exactly half of prospective homeowners believed they would experience more difficulty affording their ideal home. Current homeowners, whose ranks are mostly Boomers and Gen-Xers, said that increased mortgage payments would mean more personal sacrifices in areas such as family vacations, home improvements and shopping.

Fed policymakers have said the pace at which they’ll raise interest rates will be gradual – an increase of a quarter of a percentage point is typical. A similar rise in mortgage rates would add about $43 a month to a hypothetical $300,000, 30-year mortgage with a 3.75% rate. A bump in mortgage rates has more bark than bite. According to a study by the National Coffee Association, the average American spends about twice as much every month on coffee.

So, what’s the message? As always, our agents and the industry as a whole must take great care to educate buyers and sellers about the real estate process, which includes mortgage rates. A Fed rate increase may grab people’s attention, yet the cost of borrowing money to buy a home remains historically low by all measurements. From our perspective, even though we can’t predict the future, it looks like mortgage rates will remain attractive, and that’s good for consumers and the real estate market.

GINO BLEFARI is CEO of HSF Affiliates LLC. You can follow Gino on Facebook, Instagram and Twitter.

Great commentary Gino.

LikeLike